What is the impact of artificial intelligence for innovation?

The AI. name given to “the intelligence of machines and software” (wikipedia) was at the heart of the Thematic Meeting of the Paris Club of Directors of Innovation of 20 September 2018.

“If big companies are today more and more involved in the use of data (big data, smart data, proprietary data), artificial intelligence (AI), necessary to value and give some intelligence to the data is still quite limited in the design of innovation projects. This is due to the recent character of AI, which should neither be overestimated nor underestimated current operability and potential. As expressed by Marc Giget, president of the Club of Directors of Innovation, to introduce this meeting.

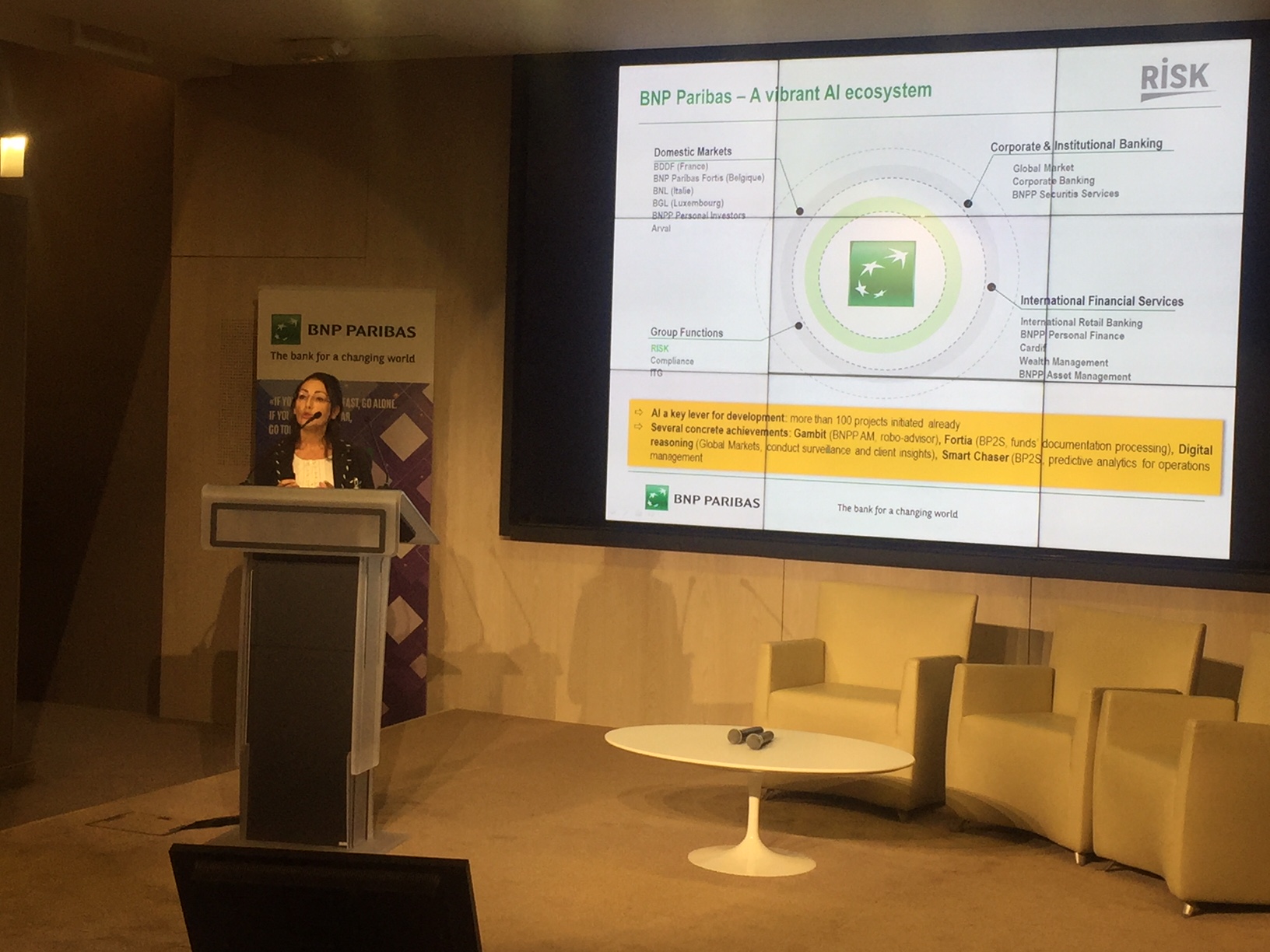

A leader in innovation, BNP Paribas opened the session, which continued with interventions by companies involved in the application of AI such as Microsoft, Bouygues Construction with its Tunnel Lab, Axa …

For BNP Paribas, it is Julien Cuminet, the group’s Chief Risk Officer, who opened the interventions by explaining why innovation and IA are inseparable. “In the bank we need to manage our risks well; the industry is very advanced: sectors such as aeronautics know how to anticipate weak signals or the railway industry. We need to go further and that’s what we do through co-creation to join forces and find original solutions. “

It was then Rim Tehraoui, Head of Risk Anticipation BNP Paribas, who presented the development levers interesting for BNP Paribas and which are at the heart of the innovation strategy. When we look at all of our businesses we have the conviction very strong that AI is a key factor; moreover, we have identified more than 100 projects impacted by the IA, at different levels of maturity, from the ideation to the POC.

For example a robot that facilitates the risk assessment of credit and fraud with an algorithm to create a predictivity analysis incorporating the issues of “early warnings”.

How to integrate AI into processes? BNP Paribas has identified these essential enablers:

“All these enablers are challenges” says Rim Tehraoui

The 1st challenge is technological, that of the data. It is not yet treated at the level of the expected potential; it is a matter of defining how to interpret them and how to articulate them between the various trades; it is a question of creating the articulation by désiloïsant these data and making exploitable these datas.

This challenge involves risk management of the use of AI in the banking system which is highly monitored, highly regulated; there is also the technological risk of integrating new technologies into obsolete systems, which risks precipitating obsolescence. In addition, the numerous partnerships, particularly with the Fintechs, create areas of vulnerability.

The 2nd challenge is the human dimension. There is anxiety around the impact of iA on jobs. The machine increases the human but we can not underestimate the risk of employee disengagement. We are in a period of transition and many are afraid of the end of their job.

Finally the failure is not in our culture. « For 1 success story many are the failures ». It is not necessary to retire too early or penalize the carriers of projects which did not reach the first time!

To conclude, we need a pragmatic approach that reconciles both simple projects with quickwins and, at the same time, a longer vision. in any case to move forward, we must touch the organizations.

This is the priority challenge to go further in AI, beyond technology, rethink the human dimension and culture and organization

Leave a Reply

Want to join the discussion?Feel free to contribute!